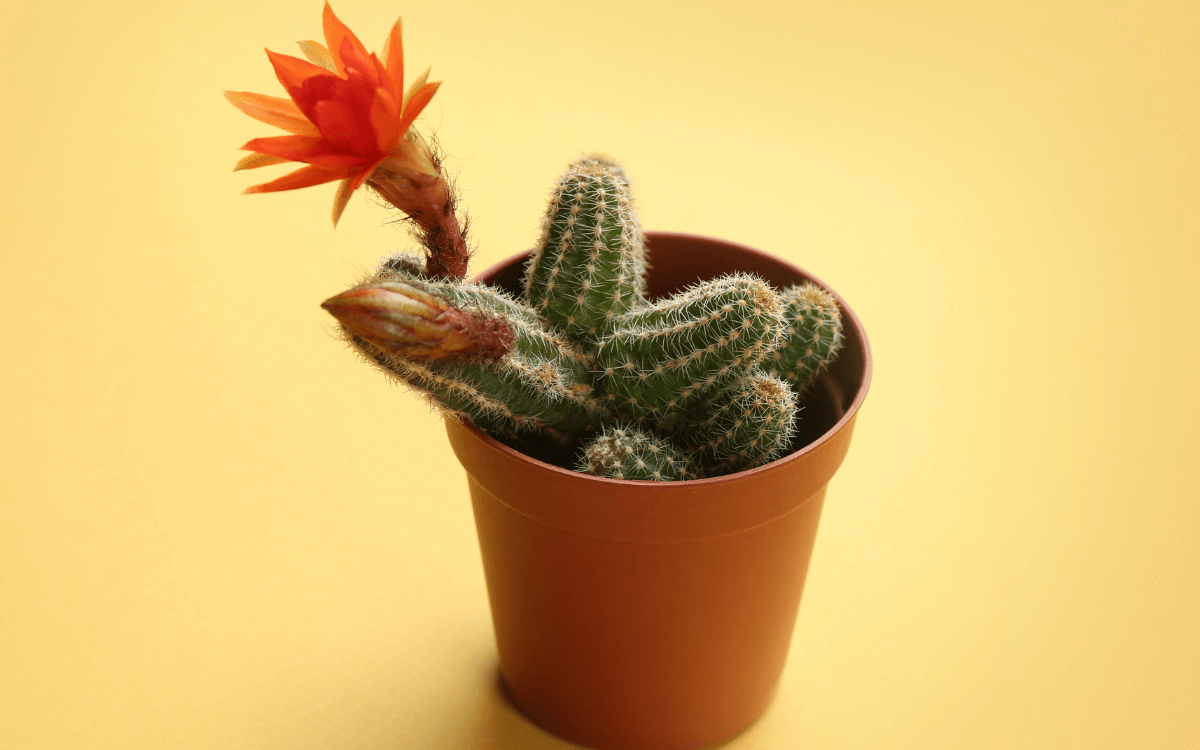

Spiral Cactus – Photos and How to Care

The spiral cactus, scientifically known as Cereus peruvianus ‘spiralis’, features a spiral growth that sets it apart from other plants. Continue reading, because in this article you will see several pictures of this plant, curiosities, and essential tips for its cultivation. Characteristics and Curiosities of the Plant The spiral cactus is native to Peru, which … Read more